As the name suggests, Term Deposit is a type of saving where the money is invested for a fixed period of time on which a fixed amount of interest is earned. Unlike regular saving account, interest earned in term deposit is higher. However, the deposit amount is blocked for a specific period, which cannot be withdrawn till completion of this period. The longer the deposit period, the more interest earns.

Customers are more interested to save money and want their money to earn for them. Thus, they opt for term deposit as a safe and secure mode to earn extra money from the money in hand. Term deposit is a more systematic investment for a customer over a period of time.

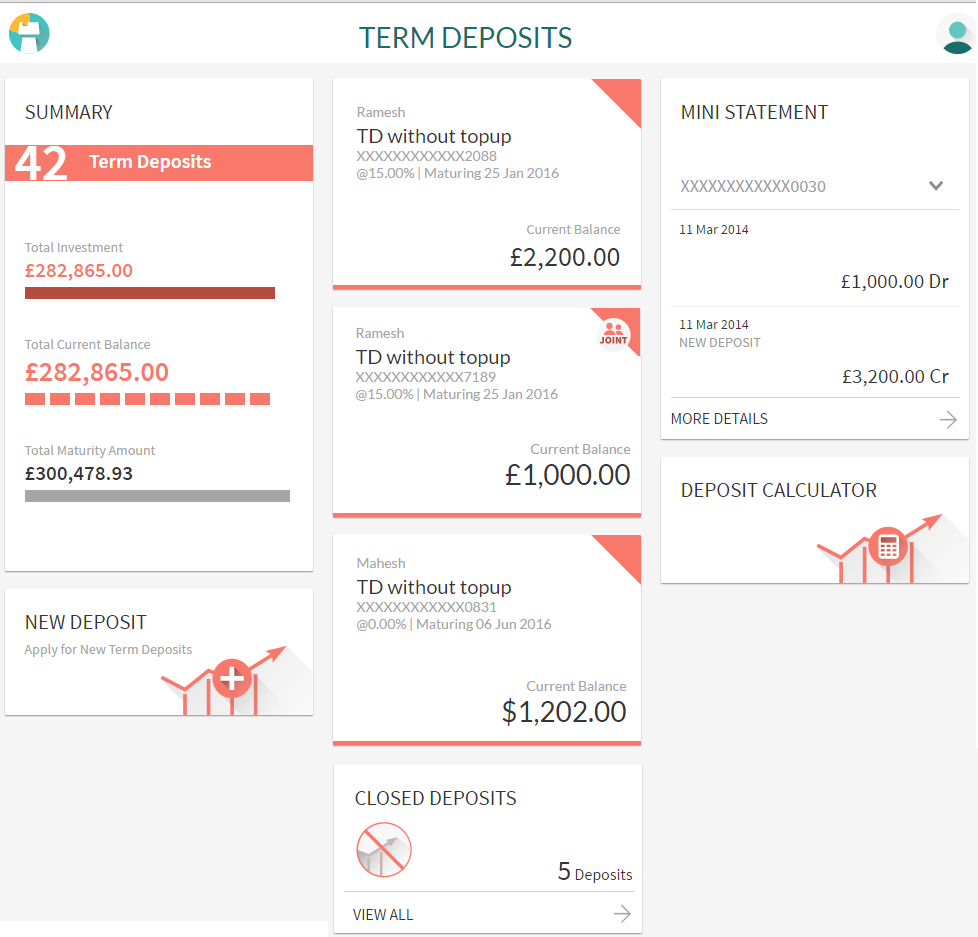

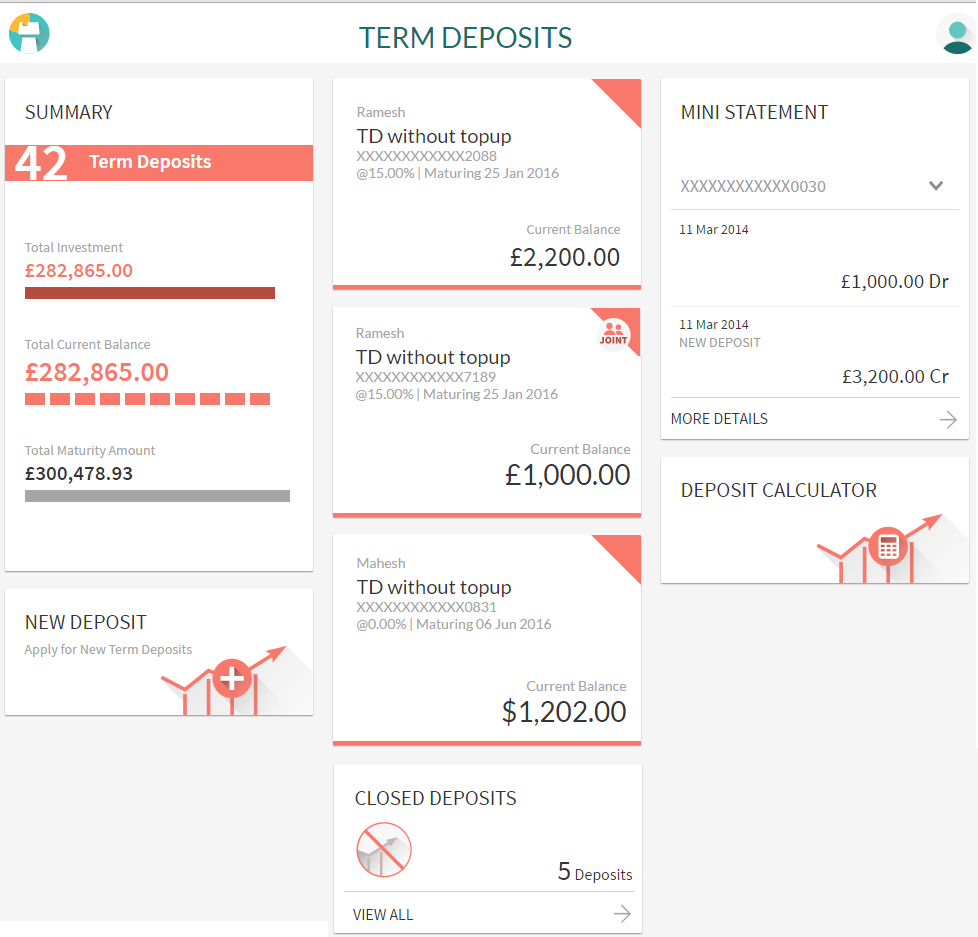

Term deposits can be accessed via Deposit Dashboard in the application. The Dashboard allows the user to mange the deposit effectively and efficiently. It provides a complete view of the term deposit(s) for active as well as closed term deposits.

Dashboard for term deposit gives a holistic view of all term deposit held by the customer. Term deposit dashboard helps customer to access any of the term deposit feature start from applying for a new term deposit till viewing of closed term deposit details.

Below are the components of the term deposit dashboard:

Click on individual components to view in detail.

|

Deposit Account Card It displays the details like:

|

|

|

Mini Statement It displays the latest transactions performed on the term deposit. You can also view the detailed statement. The mini statement includes:

|

|

|

New Deposit Click this section to apply for a new deposit account. |

|

|

Summary This card displays the summary like:

|

|

|

Closed Deposits It displays the total number of closed term deposits. Click this section to view details of all closed term deposit accounts. |

|

|

Deposit Calculator It displays the deposit calculator to calculate the interest on total value of deposit at maturity. Click this section to access the term deposit calculator. |

|

FAQs