Banks lend money to their customers through loan accounts. Hence, loan accounts are valuable assets to the bank. It becomes important for the banks to enrich end user’s loan servicing experience to increase customer satisfaction and retention.

In order to achieve this, banks are constantly putting efforts to enhance their online channel banking experience for their customers by introducing and revamping loans servicing features on digital platform.

Application provides a platform for banks to enable their customers to service Loans module through self service channels.

The customers can manage their banking requirements efficiently and effectively through self service channel. It allows customers to view their accounts, outstanding balances, make repayments, view loan schedules etc.

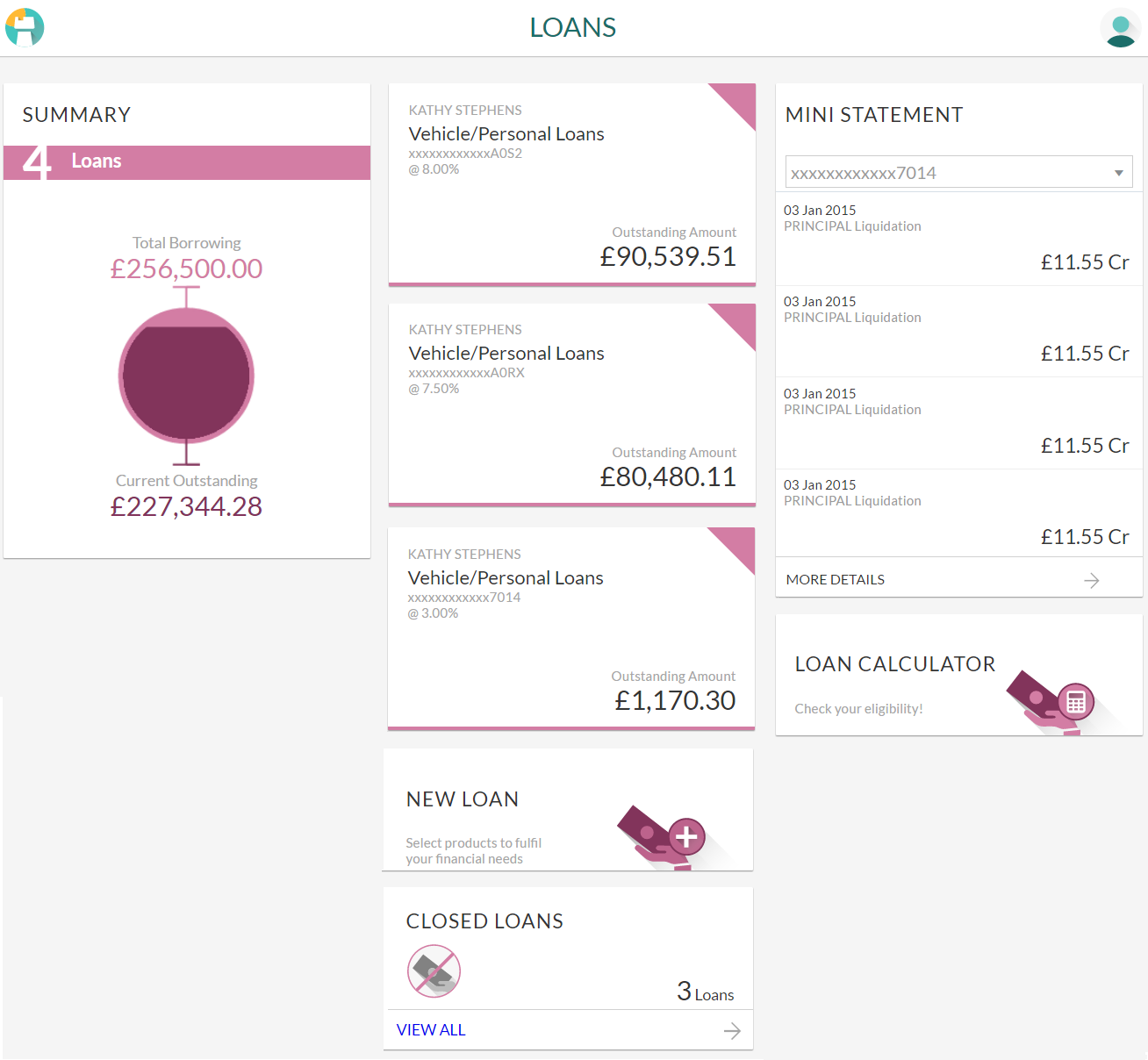

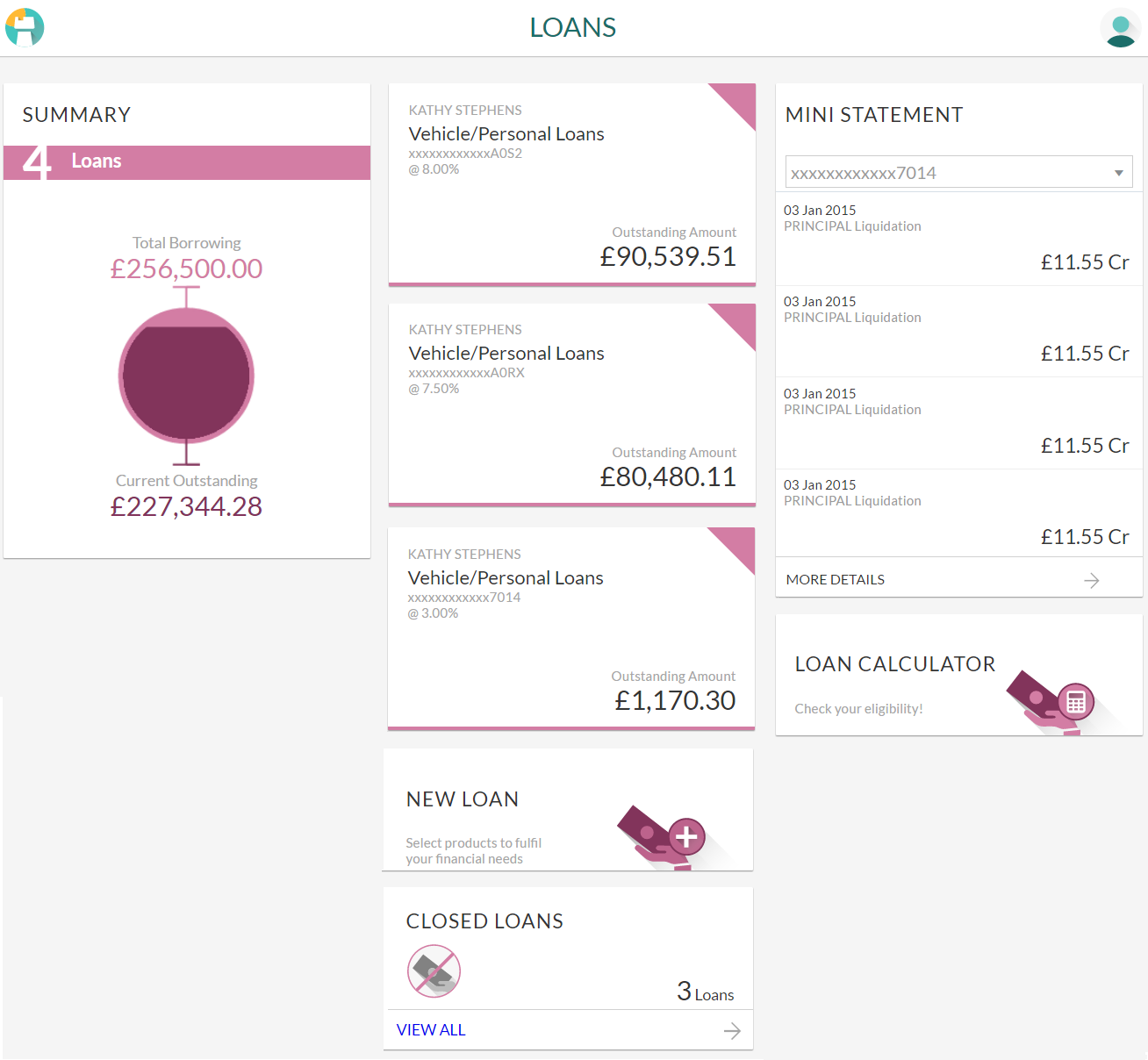

Loans dashboard provides a summary of the Loan accounts held by the customer. Loans dashboard displays summary of total borrowings done by the customer in all accounts along with the current outstanding amount. It allows customers to understand their current position with respect to loan accounts. Summary of individual Loan accounts will be displayed on the user’s dashboard.

User can view account details such as customer name, product name, account number, rate of interest, outstanding amount and joint account indicated on the dashboard for individual accounts. The system will fetch the details for all loan accounts linked to the logged in customer id and display to the customer.

When the customer logs in or is navigated to dashboard from any of the screens, system will retrieve the account statement details and displays it in a mini statement widget. Mini statement of only one account will be displayed at a time. Latest transactions made the account will be displayed in ascending order. Customer can select the account number of available accounts. Every time account number is changed, the system will retrieve account details. The customer can navigate to account statement screen to view complete details of the transaction or download account statement.

At times a customer needs to refer their previous loan accounts which are in closed status. A summary of such closed accounts is displayed on the dashboard. It allows user to navigate to the view closed account details screen.

Customers can initiate requests for opening a new loan account through the dashboard. On initiating the request customer will be navigated to the product showcase screen of origination module where various products and offers hosted by the bank will be available for selection.

Click on individual components to view in detail.

|

This section displays the analysis of all loan accounts held by the customer. It provides the Total Borrowings and Current Outstanding for the all credit cards mapped to the customer. It includes details like: |

|

|---|---|

|

|

|

This section displays all the related information about the loan account. It includes details like: |

|

Click on account card to view the respective loan account details. For more information click here. |

|

|

Click this section to apply for new loan. This invokes the loan origination flow. |

|

|

Closed Loans |

|

|

This section displays the count of all the closed loans. Click View All to view all closed loan accounts. |

|

|

Mini Statement |

|

|

This section displays the last few transactions on loan accounts linked to the customer. |

|

|

The each transaction in mini statement includes:

Click More Details to view all transactions in the account along with details. |